Deposit Reclassification enables banks and credit unions to effectively free low-earning and non-liquid funds from required reserve balances held at the Federal Reserve Bank to use for loans and other higher yield investment opportunities.

What is Deposit Reclassification?

How does Deposit Reclassification work?

Why is Deposit Reclassification important for financial institutions?

When should Deposit Reclassification be implemented?

The history of Deposit Reclassification

Under Regulation D, a depository institution is required to keep a certain amount of its transaction deposits at the Federal Reserve Bank based on a predetermined reserve ratio; known as a reserve requirement. The institution's total net transaction accounts determines if it has to keep 3 or 10 percent of its transaction deposits at the Federal Reserve Bank.

Under Regulation D, a depository institution is required to keep a certain amount of its transaction deposits at the Federal Reserve Bank based on a predetermined reserve ratio; known as a reserve requirement. The institution's total net transaction accounts determines if it has to keep 3 or 10 percent of its transaction deposits at the Federal Reserve Bank.

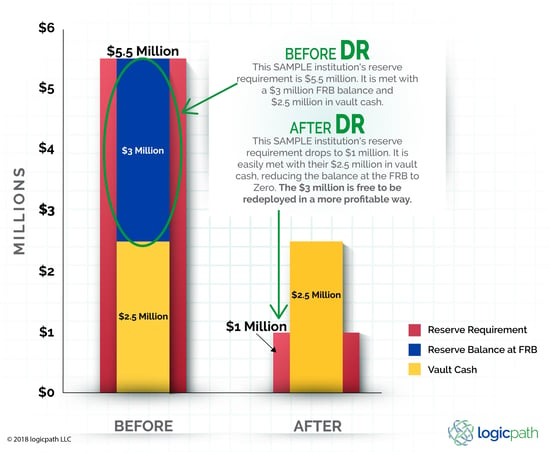

Compliant with Regulation D , Deposit Reclassification is a Federal Reserve Board-acknowledged practice that reclassifies a financial institution’s transaction accounts as savings deposits, which are not subject to reserve requirements. Reducing reserve balance requirements enables financial institutions to convert idle Fed-held funds into higher interest-earning assets, creating new and permanent revenue streams.

Image source: logicpath

Deposit Reclassification works within the Federal Reserve’s approved processes and regulations. Before Deposit Reclassification, financial institutions were (and still are) allowed to sweep funds between accounts. The most common practice of sweeps is from business checking accounts into higher interest earning accounts, in what are called “overnight sweeps.”

Deposit Reclassification extends this concept of sweeps - to sweep between checking accounts (subject to reserve requirements) and savings deposit accounts (not subject to reserve requirements).

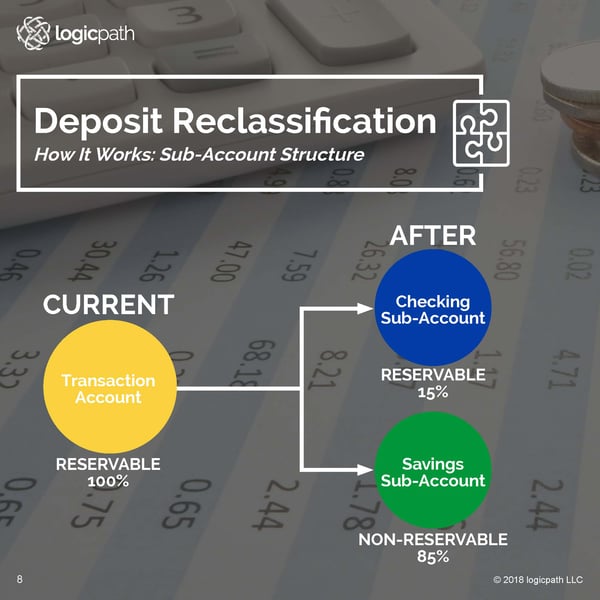

Deposit Reclassification, also called a retail sweep program, implements these sweeps by creating a checking and savings sub-account for each transaction account holder. Daily sweeps are performed between each account holder’s checking and savings sub-account to sizably reduce a bank or credit union’s reserve requirement; often to amounts that are well below vault cash, and eliminates the need for reserve balances.

Image source: logicpath

Sub-accounting allows the bank or credit union to move a portion of the customer’s funds from a transaction account (reservable status) to a savings sub-account (non-reservable status). To successfully and legally implement Deposit Reclassification, two sub-accounts must be created for each transaction account. The checking sub-account is funded at a level that covers a customer’s normal pattern of daily activity, such as typical weekly withdrawals and bi-weekly paycheck deposits. If the customer depletes funds in his/her checking sub-account, the Deposit Reclassification software automatically transfers funds to the checking sub-account from the savings sub-account.

At the sixth transfer, the Deposit Reclassification software moves the entire balance from the savings sub-account to the checking sub-account to comply with Regulation D and not adversely impact the customer.

Image source: logicpath

Customers are not negatively impacted, in any way, by either the establishment of two separate sub-accounts or the transfer of funds between them.

However, per a financial institution’s terms and conditions, customers must be notified of the implementation of Deposit Reclassification, and such notifications must include a complete description of the changes.

A financial institution’s main goal, like most businesses, is to increase efficiency and profitability, and one of those ways is to minimize non-interest bearing and low-earning assets. A large low-earning asset for most institutions is its Federal Reserve balance due to reserve requirements.

The Federal Reserve’s Regulation D sets out uniform requirements for all depository institutions’ reserve balances - either as vault cash or as funds held with their local Federal Reserve Bank.

Deposit Reclassification allows financial institutions to reclaim portions of its Fed balances due to reserve requirements, and invest that money into the institution and community.

A bank or credit union’s motivation to implement Deposit Reclassification depends on costs versus benefits. Implementing Deposit Reclassification makes sense at all times, but is even more important during the following three scenarios:

1. In a rising interest rate environment

A rising rate environment presents financial institutions with a profit-making opportunity that they can capitalize on. This is an excellent time for banks and credit unions to eliminate Federal Reserve balances, and deploy their freed-up funds for more profitable lending and investment, relative to the minimal Fed Funds that they currently earn on reserve balances.

2. When a bank or credit union sees deposit growth

Banks and credit unions’ reserve requirements increase as a percentage of their liabilities, and jump from 0 to 3 percent when the cumulative amount in net transaction accounts exceeds the exempt tranche amount, which for 2018 reserve requirements, is $16 million. Then jump from 3 percent to 10 percent when the net transaction accounts exceed the third tranche amount, which for 2018 is $122.3 million. When a financial institution experiences a growth in deposits (net transaction accounts), the dollar-amount of its reserve requirement also goes up.

3. Planned or Recent M&A Activity

M&A results in an increase in net transactions accounts, and a subsequent increase in reserve requirements. As part of its due diligence before the M&A deal, it’s important that the surviving or acquiring institution review the total merged transaction accounts to get a handle on how reserves might be impacted after the combination.

Alternately, in cases where one of the parties to an M&A transaction already has a retail sweep program, steps must be taken to ensure the program covers all transaction accounts at the surviving combined entity. It’s fairly common to have retail sweep programs continue to run as before, without adding the non-surviving entity’s accounts to the Deposit Reclassification program. This oversight typically causes financial institutions to return to a reserve position, and requires them to hold a Fed balance.

Deposit Reclassification only takes about 60 days to implement from start to finish. Then it takes an additional two weeks after going live with the program to see Fed balances drop, typically to zero. If financial institutions hold off on implementing and start thinking about Deposit Reclassification after they have sizable reserve requirements, their assets will be tied up in reserves, earning Fed funds for at least 10 weeks, and be unavailable for lending. It pays to implement Deposit Reclassification well before deposits and associated reserve requirements rise.

After Nicholas Ceto, Jr. retired from the consulting firm, KPMG, as National Partner in charge of their Revenue Enhancement Consulting Services, he founded Ceto and Associates, an Atlanta based management consulting firm for banks and credit unions.

One of Ceto’s first independent projects was to look for revenue enhancement opportunities at Integra Bank. Upon examining their business and their books, Ceto noticed Integra’s huge balance at the Federal Reserve Bank, and his training and knowledge of the inner workings of the Federal Reserve immediately kicked in.

Ceto was intimately familiar with the Fed’s Regulation D and had a breakthrough that Integra could move money from checking accounts (subject to reserve requirements) to savings accounts (not subject to reserve requirements), up to six times a month, and reduce its extraordinarily large Fed balance. He then proposed a final Deposit Reclassification plan for Integra to the Cleveland Fed. It was found to comply with all regulations and the Fed gave Ceto and Associates the go ahead. Thus, the first Deposit Reclassification project was born in 1994; it increased Integra’s earnings by $30 million per year, and went on to increase earning assets by billions for financial institutions across the entire U.S. since its inception.

Since then, Ceto and Associates moved the Deposit Reclassification software to its sister company - the firm logicpath, which focuses on providing software to banks and credit unions; to maximize efficiencies, manage risk and improve earnings through solutions such as retail sweep programs.

Copyright © 2026 logicpath