Did you know that credit unions and banks, not retailers, have one of the most complex supply chains? Specifically, I am referring to the cash supply chain.

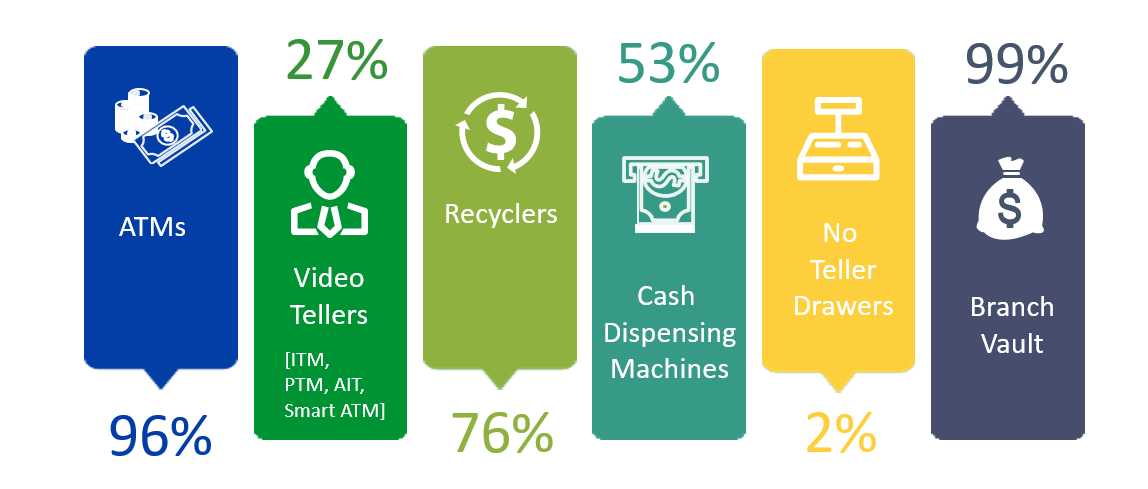

When supply chains are dissected down to the granular level, overall cash supply chain management has a lot of moving parts. A main influencer is the increased use of more complex technology across the supply chain including ATMs, Video Tellers, Kiosks and Recyclers.

Banks and credit unions, not retailers, have some of the most intricate supply chain systems in the world. The main influencer is the increased use of more sophisticated technology such as ATMs, Video Tellers, Recyclers and Kiosks.

Supply chain management (SCM), or inventory management, is the process and activity of sourcing materials that an enterprise needs to create a product or service and deliver that product or service to its customers.

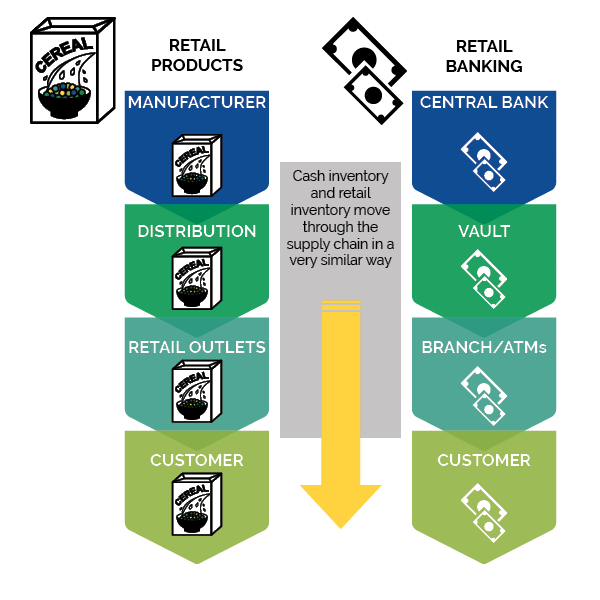

SCM applications are used by almost every other industry today. Banks and credit unions are behind the times regarding supply chain management. Retail products and currency move in a very similar way through the supply chain.

The image to the right depicts a box of cereal moving through the retail supply chain compared to currency moving through the bank supply chain.

The goal of SCM software and consulting is to improve supply chain performance. Timely and accurate supply chains allow businesses to order and ship only as much product that is needed for a given time period, with buffers. Effective supply chain systems help both suppliers and locations reduce excess inventory. This decreases the cost of producing, shipping, insuring, and storing product that is unused.

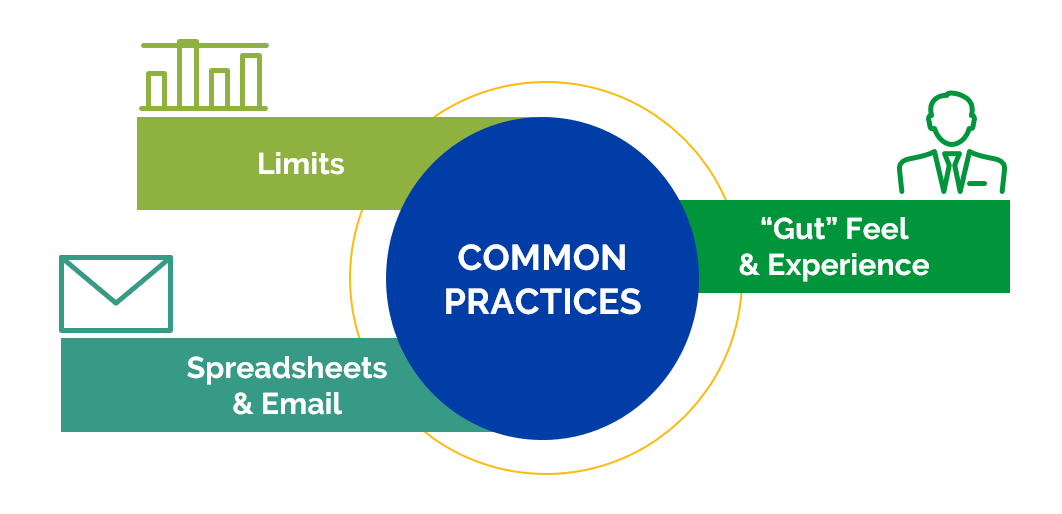

Today, most banks and credit unions use a homegrown manual system to manage currency throughout the supply chain. To predict how much of each denomination a branch needs at each cash end point, the banking industry typically relies on static limits, manual excel spreadsheets, emails, gut feelings, fear of running out of cash and branch manager experience.

Additionally, a branch usually has a security limit set by the armored car carrier and bundle rules set by the money supplier. The end goal is to service customers, but not have too much sitting idle for security purposes. The bank must calculate the correct replenishment and delivery schedule based on all these factors. Additionally, each branch or ATM location has its own unique demands based on their cash technology including ATMs, ITMs, cash dispensing machines (CDMs), and recyclers, so each location needs to be calculated separately.

Based on data received from over 300 banks and credit unions with $300 Million to $50 Billion in assets, the complex technology numbers speak for themselves.

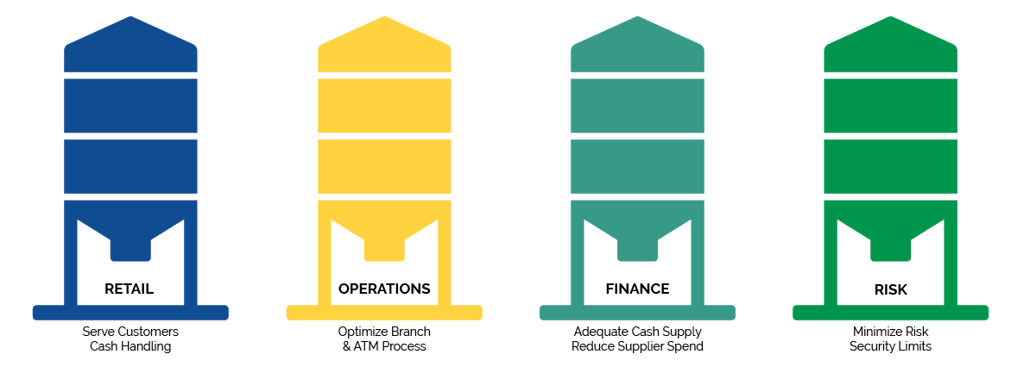

Departments in a bank are affected by supply chain management and often operate in silos because of the manual processes hiding inside the bank as shown in the graphic below.

Departments Impacted by the Cash Supply Chain

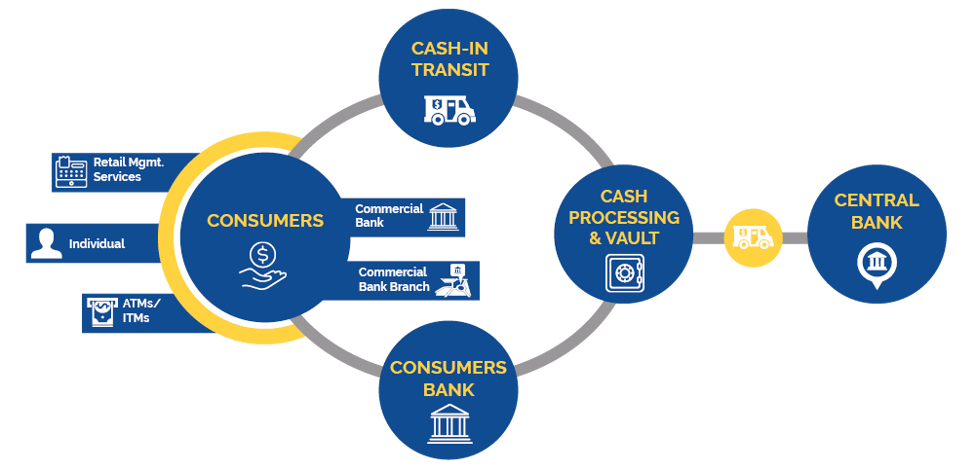

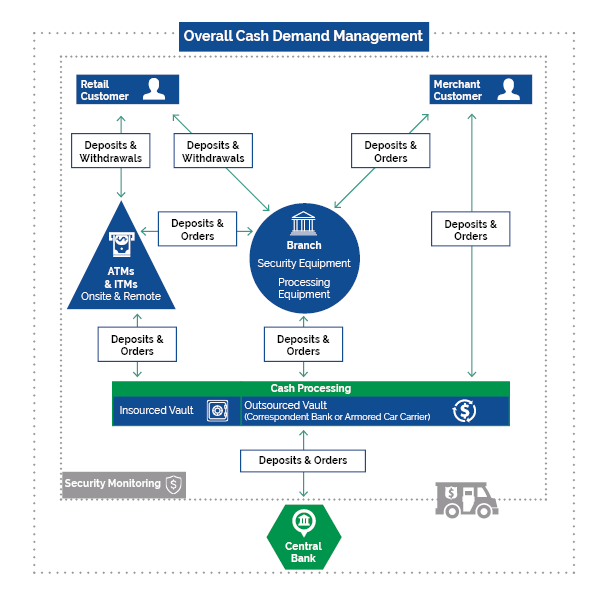

Bank cash supply chain management contains many moving processes. The image to the right shows the flow of cash through an entire network. There is a lot of equipment, services and processes required to distribute cash through the network.

Orders and deposits can occur with the central bank, the money supplier, internal/external vaults, ATMs, ITMs, and recyclers. Then the usage changes day over day by the merchants and customers' demand.

Many retail banks and credit unions have not effectively addressed the growing complexity of their devices and supply chain. Most financial institutions have 20-30% in excess cash across their branch, ATM, ITM, Vault and device network. Deloitte and Diebold Nixdorf have both reported that ATMs/ITMs have on average 40% excess cash. Additionally, most financial institutions have not maximized their effectiveness on armored courier services by calculating delivery cost vs. cash usage vs. carrying costs.

There are many challenges currently facing banks and credit unions specifically as it relates to the COVID-19 Pandemic,

This current pandemic has led many regulatory bodies including the FFIEC, FDIC, NCUA, OCC & Federal Reserve to update their recommendations for Business Continuity Planning (BCP) and Pandemic Planning for the first time in 13 years. That takes us back to before the 2008 financial crash. This updated guidance identifies the actions that financial institutions should take to minimize the potential adverse effects of a pandemic.

Updated Guidelines & How It Relates to the Supply Chain for Cash:

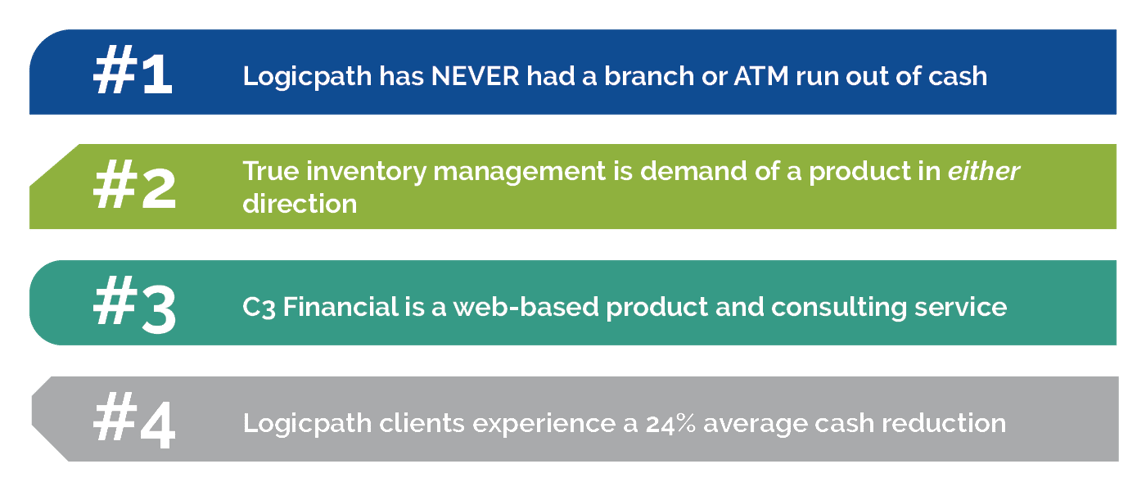

C3 Financial is a cloud software solution which focuses on Cash Operations and Management and Process Enhancement and Cash Optimization.

“Lake Trust Credit Union needed a streamlined and centralized cash ordering process for its branch employees…We sought a software solution that enabled one group to manage the branch cash ordering, not each individual branch. The charts and graphs easily identify peaks and valleys in the day-to-day branch ordering process."

“HarborOne Bank required a centralized solution to manage the bank’s expanded cash inventory in efforts to streamline operations and align all aspects of the bank’s cash management process…”

"C3 Financial’s central requisition console and file extract feature for FedLine® Web enables AltaOne employees to receive and approve accurate order recommendations, then easily send all cash orders in one file for the credit union’s 12 branches and 15 ATMs directly to the Federal Reserve Bank.”

“C3 Financial’s central requisition console to consolidate all of our cash orders for mass submission to our virtual vault with our armored car provider (Loomis).”

“To support this level of growth, we required centralized cash management software that enabled our personnel to meet and sustain our high levels of member service throughout our network. C3 Financial provides us with optimal cash inventory at all locations.”

Founded in 2008 in Atlanta, Georgia by Douglas Ceto, logicpath has a client portfolio that expands across all 50 states and Canada. Logicpath is proud to have earned the trust of over 2,000+ banks and credit unions with asset sizes ranging from $18 million to $99 billion.

Learn more about our company here.

Copyright © 2025 logicpath